Over the last few years, I’ve had the opportunity to work for a variety of B-to-B companies, in a wide variety of sectors, from biotechnology to software and from dairy producers to paint manufacturers.

And while these companies are all at different stages in their life-cycles and operate in different businesses or geographies, they all share a set of similarities:

- They started out by satisfying a very specific need in the market

- They usually have a strong R&D capability that has helped drive growth through innovative products and solutions

- They’ve often grown (globally) and expanded their market share through acquisition

- They sell primarily through distributors and agents (exclusive distributor contracts for example) even if some of them have their own sales force

- They’ve shown consistent growth over the years or decades but sustaining this growth requires more and more efforts (law of diminishing returns)

- Over the years, competition has started to enter and crowd their market, often attracted by the profit margins and growth rate in the category

- They are typically led by the sales departments with support of marketing rather than the other way around

- They often carry a large number of SKUs which sometimes conflict with each other, usually the result of accommodating the individual needs of their customers

- The sales force generally, and understandably, focuses on the lowest hanging fruits to secure their own bonuses rather than selling more holistic solutions that are more aligned with the strategic vision of the company or the needs of their customers (product focus versus a focus on customer needs)

These companies have been and are generally very successful (and profitable) but they all will reach a size and scale where sustaining growth requires more and more efforts both in terms of resources and capital and people. As a result, they will inevitably need to become more strategic in their go-to-market strategy and marketing. That means they will ultimately have to:

- Develop a customer segmentation strategy

- Create a brand and product portfolio strategy

- Define a corporate brand positioning platform (what story to tell?)

- Adjust and evolve their Go-to-market strategy

- Define their key customers Decision Making Journey

- Embrace a more strategic approach to marketing

Let’s dive into those challenges in detail:

1. Develop a customer segmentation strategy

A customer segmentation generally groups and differentiates a company’s customers and potential customers based on a set of shared criteria, need states and drivers which allows it to market to these different segments as a group. The differences between customer segments can be anything from a different level of price sensitivity, a different stage on the maturity curve, a specific attitude towards science and technology, a specific competitive behavior and/or actual engagement with the category, etc.

A customer segmentation often becomes a necessity to better classify and thus better market to the various customer segments with tailored marketing programs, product and messaging strategies, thus avoiding waste, inefficiencies and overlap. A customer segmentation approach will also allow the company to identify the most valuable customer segments (in terms of size potential, growth opportunity, profit, etc.) and thus focus its resources on where it matters.

A small hospital in a remote location in Russia (a growth segment) will for example have very different needs than a large urban hospital. A small farm in Turkey may have similar needs than a small farm in the US but those will be very different from the needs of a large farm in Germany or China for example. Grouping your customers based on a set of relevant criteria is often the starting point for a more efficient approach to marketing and the foundation of what follows.

2. Create a brand and product portfolio strategy

In addition to a customer segmentation framework, these companies will inevitably also have to create a brand or product portfolio strategy that clearly differentiates and prioritizes the different value propositions of the different brands within the portfolio and help organize the product portfolio around the key customer segments and their needs. It basically allows the company to re-align its brand and product portfolio against the relevant customer segments.

A portfolio strategy prioritizes and provides focus. It also allows to “bundle” different products into “solutions” and evolve the organization from a focus on selling products to a focus on customer needs and selling solutions. A client I recently worked with had me help them reorganize their large product portfolio, the result of various acquisitions, around relevant customer needs.

Doing so will enable to determine which brand(s) should target which customer segment with which products, benefits and messaging platforms at what price point, thus providing a more targeted and efficient marketing approach and marketing spend. I’ve seen organizations approach the same customer with 2 different salespeople representing two different brands within the company in the same week. Very confusing for the customer and very inefficient.

A brand and product portfolio strategy will also allow for a prioritization of the company’s resources and help guide the way innovation spreads across the portfolio. No need to add your latest product innovations to your point-of-entry and value offering for example, something the sales force will champion and encourage without a clear portfolio strategy.

Last but not least, a clear portfolio strategy will help the organization decide whether it has too many or too few brands in its portfolio, whether some of its brands overlap and compete for the same customers, and whether there might be opportunities for new brands within the portfolio to satisfy unmet customer needs. As incredible as it sound, we were recently able to show to a client (and quantify) that all their products overlapped and “competed” for the same few need states whereas half the need states in the category were left unsatisfied by the current product offering and required new product solutions.

3. Define a clear brand positioning for the organization

in my experience, most of this type of companies already have a strong reputation and clear equity elements built over time and through the many products and many interactions the company has had with distributors and with customers. Most of these companies also have a strong sense of self. However, they often struggle to translate this reputation, heritage, equity and sense of self into a brand positioning platform that resonates with its core customer segments. Further, many of these companies are associated with and communicate the generic category benefits. Which makes sense since they usually were the ones creating the market and since they’re often the perceived dominant player in the category.

This is where capturing, and aligning behind a brand positioning platform will help an organization stand out among competitors, move its value proposition beyond the generic category benefits, and allow the organization (from the CEO to the sales team) to tell a consistent story.

The challenge here is often in aligning the different internal point of views within the organization while also ensuring that this collective brand positioning is perceived as appealing by retailers, distributors and customers. It is a challenge but also an exercise that in my experience can benefit from an external facilitator. We’ve for example been able to facilitate global positioning workshops bringing together anywhere between 12 and 17 representatives from various geographies and help them rally around one coherent, collectively crafted brand story, something the company had tried to do for years.

4. Adjust and evolve their Go-to-Market strategy

Once and organization has defined a customer segmentation strategy, a brand and product portfolio strategy and a clear brand positioning, the next essential step is to re-define the go-to-market strategy.

Most of these companies already have a successful go-to-market approach in my experience, that has enabled them to grow to where they are today. However, taking the more strategic approach described above will require some changes and adjustments on how to approach the market. In my experience, the challenge in changing the go-to-market strategy has more to do with “cultural change” than with changes in processes and structures, as employees, especially the sales force, will be asked to change their approach to selling, something that is often perceived as a risk and (perceived) threat to their bonuses.

One way to mitigate this change and risk is to roll out this new go-to-market strategy on a smaller scale first, say in one specific country or region (for a global brand for example), learn from this step, adjust and ultimately scale it across geographies.

A global company I recently worked with decided to implement a newly defined go-to-market strategy centered around a new customer segmentation and brand portfolio strategy in a couple of smaller countries first. In fact, while there was overall consensus that this was the right approach, there was still a lot of a hesitation among some of the key regional stakeholders. This “test market” however was so successful and the change on the business so impactful and so immediate that 9 other countries decided to implement this new go-to-market strategy within that first year, and way ahead of the agreed upon two to three-year timeline.

5. Define their key customers Decision making journey

This type of organization usually has a very good sense for where and how to reach their customers. Especially if this company has its own sales force that interacts regularly with its customers.

The challenge therefore is not so much to understand where to reach potential customers with what type of messaging. Rather the challenge here is usually to identify the most relevant points of interaction and prioritize the company’s marketing efforts. A client I recently worked with had developed a really detailed customer journey, capturing all the touch points and need states associated with those touch points. It was extremely thorough and looked great, and yet, no one within the organization was actually using it.

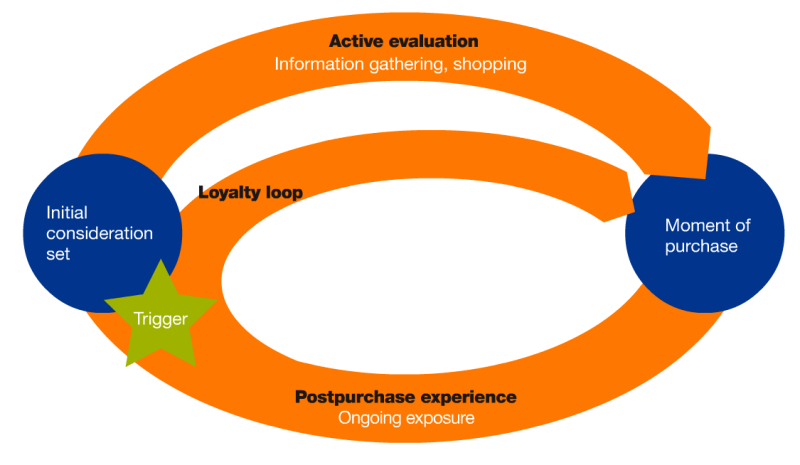

Customer decision making journeys all too often look like sales funnels, which is the wrong way to approach them. Instead they should be focused around the customers need states and pain points, of which there are usually only a couple. A well-designed customer decision making journey (meaning a customer journey that is acted upon) should identify and prioritize the most relevant and impactful touch points, allowing the organization to prioritize its efforts. A good customer decision making journey should also help a company understand what business it actually is in.

We recently worked with a client whose assumption it was that the best way to create brand preference and choice was to invite its key prospective customers, and their partners, to a fancy yearly event. Our research showed something very different. What potential customers really wanted is on-demand access to the right experts to help them answer often difficult technical questions in their day to day job and thus help them do a better job. Sure no one will turn down a fancy weekend in an exotic location (especially if the spouse is involved), but the real value our client could provide day-in, day-out was to make it easy for their customers to reach out to them and answer their technical questions.

6. Embrace a more strategic approach to marketing

Ultimately, the 5 challenges described above can all boil down to “elevating the marketing discipline within that organization from a tactical, executional role to a more strategic role”. In fact, most of these companies already have a marketing department. But those are usually responsible for the collateral material, PR, events and sales material, in other words, for the communication the company’s story and products rather than for the strategic direction of the company’s growth.

Embracing a more strategic approach and elevating the role of marketing from an executional to a strategic one is an inevitable step these companies will have to take to sustain their growth and market more efficiently and competitively. This shouldn’t be done at the expenses of the product development team and definitely not at the expense of the sales team but instead in cooperation with those departments. Ultimately, the role of strategic marketing in B-to-B is to help increase leads and sales. Or should be.

First The Trousers Then The Shoes Inc. is a brand research, strategy and innovation consulting firm. Over the year, we’ve helped many B-to-B companies generate business growth by helping them tackle some or all of the challenges described above. If this article resonated with you, please feel free to reach out to me at Ulli@first-the-trousers.com, for an informal conversation on how we could help your business succeed.

SIGN-UP FOR MY NEWSLETTER TO KEEP UPDATED

ADDITIONAL RESOURCES:

GO BACK TO 'FUNDAMENTALS” for more articles about brand strategy, brand positioning, customer insights, and creative problem-solving.

Learn everything there is to know about brand position development and become more “brand positioning fluent” than 99% of the marketing community with my online course “The Art & Craft Of Brand Positioning Development”. Learn what it is, how to set objectives for your positioning, how to segment your consumers, how to create genuinely differentiating and distinctive positioning statements, sources of brand positioning, how to assess, evaluate, and improve existing positioning statements (with examples), and learn what mistakes to avoid.

Do you just want to learn the basics of brand positioning development? Check out the award-winning “Brand Positioning Workbook: A simple how-to guide to more compelling brand positioning, faster”. Available on Amazon around the world. (RAISE the prices again?)

Working solo on a brand positioning project or preparing a positioning workshop? Check out the best-selling Brand Positioning Method Cards for guidance and inspiration.

Interested in insights and how to generate them instead? Then the Aha! The Indispensable Insight Generation Toolkit might be for you. Available as a set of method cards in the US and as a Kindle document outside the US.

Need an expert team to help you position or re-positon your brand and identify new growth opportunities? Then reach out

Alternatively, you may want punctual advice, feedback, and inspiration without hiring a consulting team. Then, book an hour of coaching with me.

It Is An Honor To Be Featured By LinkedIn

It Is An Honor To Be Featured By LinkedIn

Leave a Reply

You must be logged in to post a comment.